This blog will unveil the actual Cost of Your Employees:

An Essential Guide to

Accurate Calculation.

It is remarkable how some businesses calculate the actual cost of their employees.

- Do you need clarification or help to determine the actual cost of your Full-time hired employees?

- A big question is to choose either an employee or a consultant.

- Would you like to gain insights into what factors should be considered in evaluating whether it is favorable or unfavorable?

Navigating the challenges of Determining the actual cost

First, we need to understand the difference between the two.

The cost of the employee not only includes their salary but there are many hidden costs with it. Such as

- Fringe ( Bonus, paid paternity leave, stock options )🏆

- Health Insurance 🧑⚕️(Medical, Dental, Vision, others)

- Taxes( Payroll, Social security, medicare taxes etc) 💰

- Paid Time Off( Vacation+Sick days) 🎡

- Retirement Benefits 💸(Simply IRA, 401K etc)

Overhead costs refer to all expenses outside of labor costs, including payroll taxes, benefits, insurance, paid time off, meals, training, software subscriptions, equipment or supplies, gifts, building costs, property taxes, and utilities. These costs can be calculated monthly or annually, depending on the type of expense, and should be divided as a per-employee expense and added to the total that an employee costs you.

Consultant expenses include:

Hourly/ Project-based fees

Commissions

Legal Support

Software/Hardware

Calculating Employee cost for better understanding:

The standard work hours per year = 2080

(40 hours per week * 52 weeks per year)

Assume the annual salary as an employee to be $125,000, and thus the hourly rate will be $125,000/2080= $60

Let’s assume fringe benefits to be 40%

(These benefits can include health insurance, retirement plans, paid time off, life insurance, and other uses intended to increase the overall value of the employee’s compensation package.)

So 40% of $60 = $24, Total hourly cost will be $60+$24 = $84/hour

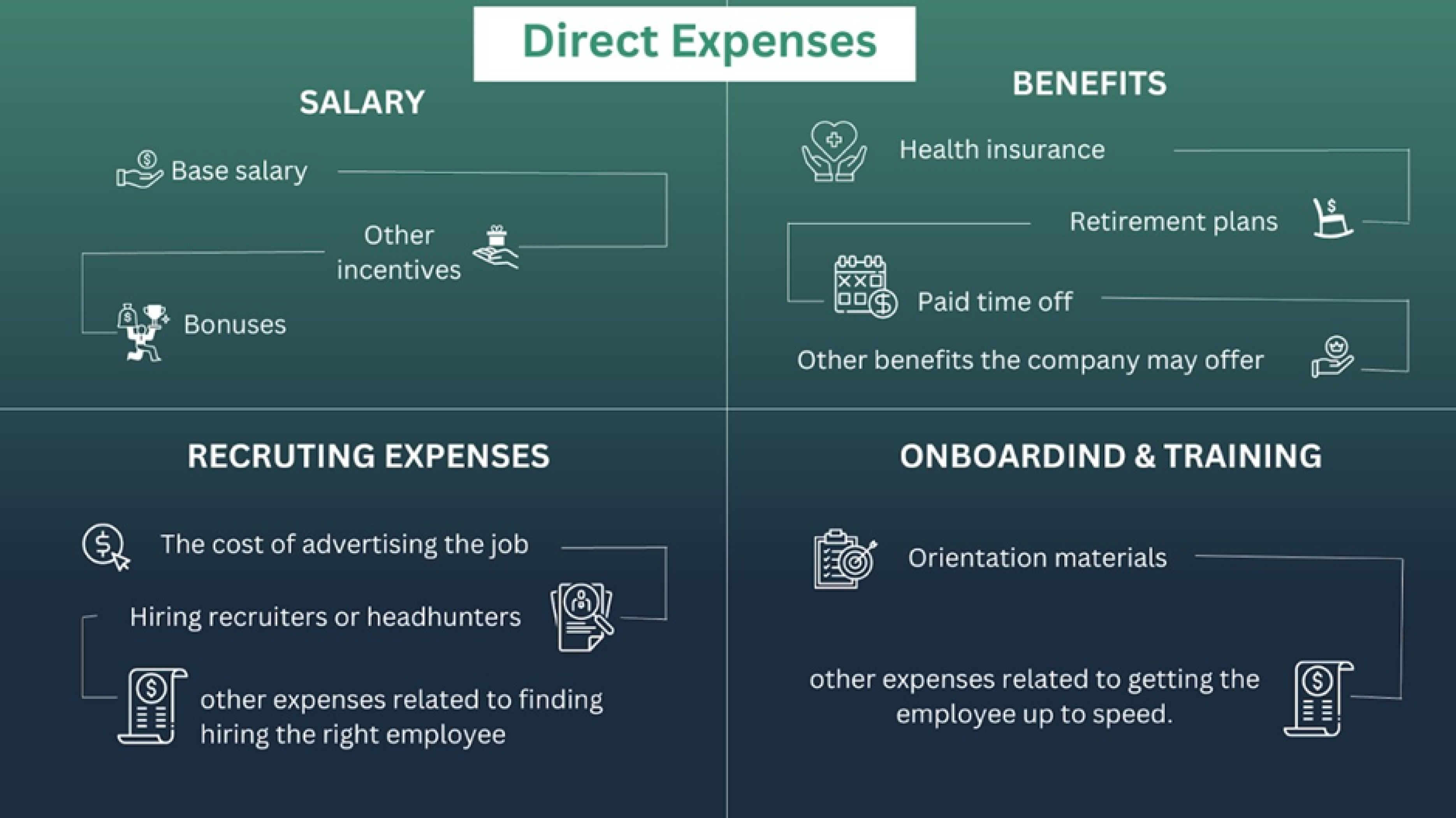

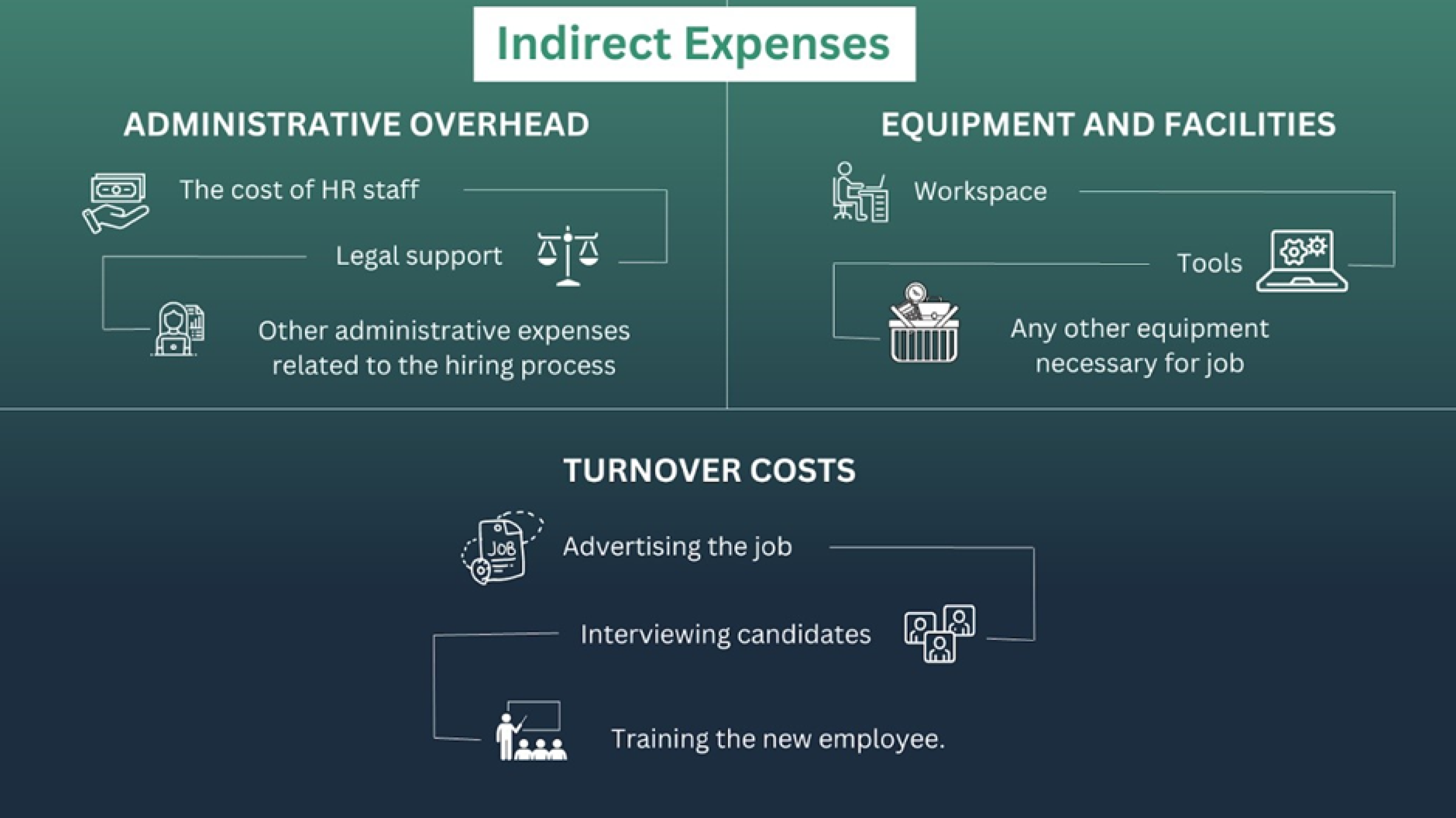

Buckle up for a wild ride of direct and indirect costs!

Calculating the direct and indirect costs of hiring an employee is essential. Considering all associated expenses is critical to determining how much an individual will cost to hire. Prepare for your journey and note all the expenses that may arise.

Listed below item such as:

Direct costs:

Indirect costs:

Do you need clarification?

Please sit, breathe, and let’s put our heads together. We understand the challenges you may be facing and are here to assist you in any way we can. Let’s take a moment to reflect and find the best solution to move forward with confidence.

With numbers dancing in your head, you might need clarification about what to consider and what is left behind. You might need help keeping track of all the calculations and equations. It can be simple to hire a consultant.

So now you can say math is easy-peasy. If you hire a consultant, let’s say at $60/hour to complete the same task. So that’s what you must pay ( including software or legal support). Fringe or other overheads are not a part of it.

“When you step back & do the math, you might find

that a consultant can save your cash.”

Now you understand that most companies are unaware that hiring employees can cost them a lot of money. If companies calculate the actual cost of the employees, there’s a higher probability that organizations would have saved a lot by employing consultants. So whether you are a product-based or service-oriented company, these mistakes can severely hurt your bottom line & can also cause you a lot more money in delivering a service than what you are billing for.

“In reality, the cost per employee goes far beyond

annual pay and hourly rates, deviating significantly

from initial calculations. This emphasizes how

expensive employee expenses are.”

Concluding Remarks

It is essential to consider all the associated costs of hiring an employee or a consultant, including any hidden fees that might emerge later. It is crucial to consider these costs to make a financially sound decision.

Due to the uniqueness of every company and situation, there is no definitive answer to this question. However, understanding the factors and issues discussed in this article can give you the knowledge to make the best financial decision for your team.

Making an informed hiring decision requires accurately accounting for all costs of hiring an employee or consultant. It is vital to consider both evident and hidden charges to make an informed decision that aligns with your team’s and organization’s needs.

If you would like to explore ways business process outsourcing (BPO) could help your business due to resource constraints and talent gaps, please contact us to discuss how we can help meet your need.

Other Blog Articles

The Accurate Calculation of Employee and Consultant Costs Opens New Doors for Your Business

Cleansing Master Data for better purchasing and supply chain decisions

Know the blind spots when implementing Digital Procurement

Increase Adoption of Procurement and Payment Technology

Outsourcing of Sourcing and Procurement Processes

Top ten contract pitfalls to avoid

Role of a Category Management function of the future

Mastering Procurement: The 7 R’s to Success

Navigating the Waters: A Guide to Incoterms in Procurement & Supply Chain

Other Customer Success Stories

We helped our client reduce their past due payments from >40% to less than 5%

We have helped the Client automate vendor payments from less than 10% via ACH to >95%

We automated expediting and supplier follow-ups

We reduced maverick spending by 75% and increased savings by 10%

We renegotiated agency rates and reduced the rate card by 20%

Interested?

If interested in further exploring this

issue, please get in touch with

to schedule a call or ask questions.

Interested?

If interested in further exploring this

issue, please get in touch with

to schedule a call or ask questions.

Related and Recent Blogs

Blog

A Guide to Incoterms in Procurement & Supply Chain

Blog

Top ten reasons contractual arrangements with suppliers fail to obtain the value envisioned by the contract writers.

Blog

As indicated in the earlier blogs, approximately 70% of digital technology initiatives fail to deliver the value envisioned worldwide when the contract is signed…

Blog

In a 2021 survey, 55% of European companies said the COVID-19 pandemic had increased the demand for digitalization…

Blog

Organizational objectives related to spend analytics typically aim to better inventory planning and reduce inventory by cleansing the item master data…

Blog

As indicated in the earlier blogs, approximately 70% of digital technology initiatives fail to deliver the value envisioned worldwide when the contract is signed…

blog

blog

blog

blog

blog

blog